29+ Mortgage principal calculator

In the example above after one year of additional payments the principal amount would increase to 13700. It calculates the remaining time to pay off the difference in payoff time and interest savings for different payoff options.

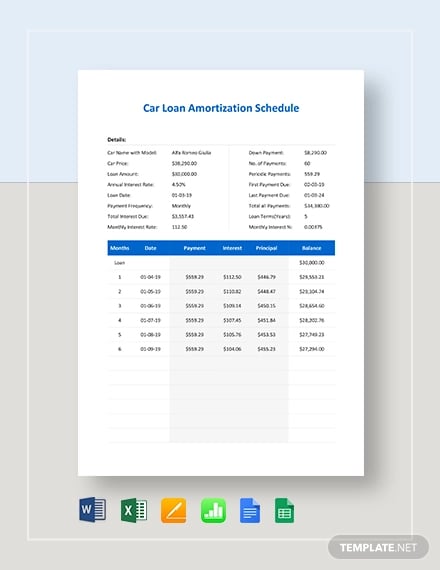

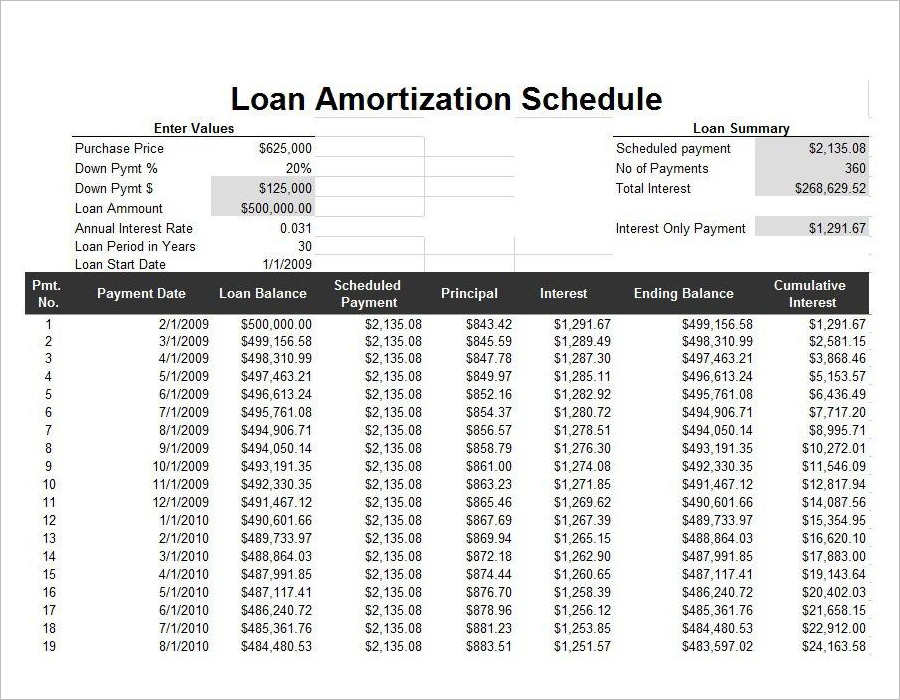

Loan Amortization Schedule In Excel Amortization Schedule Interest Calculator Excel Tutorials

When you pay your regular monthly mortgage payment you agree to perform a dozen annual payments toward the amount of principal borrowed.

. Payment Beginning Balance Principal Interest Ending Balance. Use this free Georgia Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. The lexicon isnt tricky here.

As you make mortgage payments your principal balance will decrease. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. Most loans can be categorized into one of three categories.

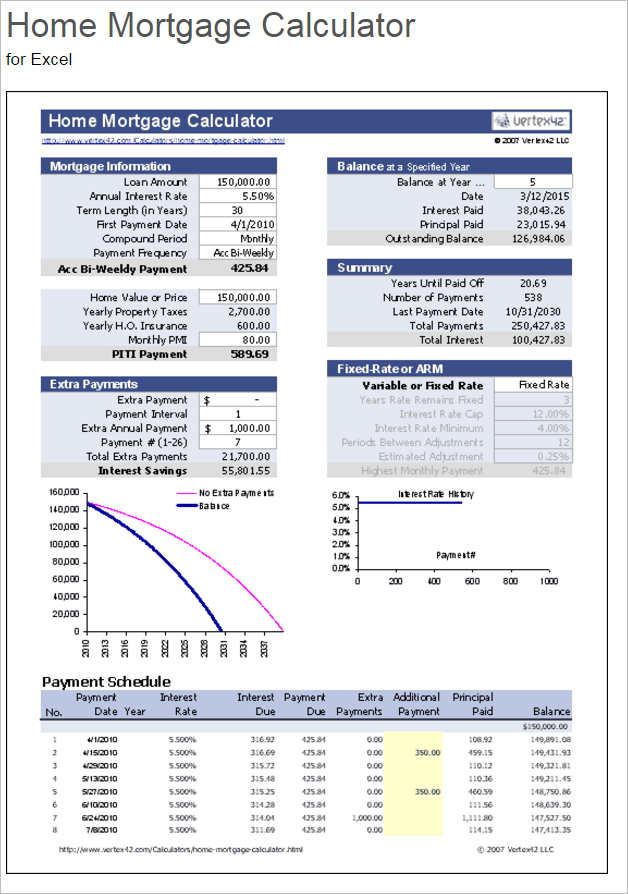

One of the worksheets in this file is nearly identical to the online calculator above and was used to help verify the calculations. The graph compares the total cumulative principal and payments to the balance over time. This is because the principal or outstanding balance is larger.

Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. A mortgage in itself is not a debt it is the lenders security for a debt. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage.

You may think 50 or 100 a month is a small sum but no amount is too small. How the New FICO Credit Scoring System Will Affect You January 29 2020. Principal The amount you owe the lender.

This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. If you make multiple types of irregular or one off payments you can put just about any scenario into our additional mortgage payment calculator and see what your current or. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

However as the loan progresses the ratio of interest and principal inverts so that eventually the principal represents the majority of the payment. If you have a 30-year fixed-rate mortgage of 150000 and your FICO credit score is within the 660 to 679 range the myFICO Loan Savings Calculator estimates you could pay 3375 APR based on interest rates as of Oct. See how your monthly payment changes by making updates to.

May 2 2017 at 129 pm. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments. Your mortgage principal balance is the amount that you still owe and will need to pay back.

While youll find PITI on virtually all mortgage payment breakdowns you may also have other expenses like. Across the United States 88 of home buyers finance their purchases with a mortgage. While the maximum affordable mortgage.

To use our amortization schedule calculator you will need a few pieces of information including the principal balance for your mortgage your annual interest rate the term of the mortgage and your state of residency. The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options including making one-time or periodic extra payments biweekly repayments or paying off the mortgage in full. You can also enter additional payments to see how this affects your overall mortgage length.

You can choose to make an. The Mortgage Calculator is crucial in determining the mortgage amount based on an affordable monthly mortgage payment. Mine is a loan where the minimum is income.

Mortgage loan basics Basic concepts and legal regulation. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or commercial lands. This calculator can help you.

Why Credit Card APRs Are Rising Despite Feds Third Rate Cut of 2019 November 4 2019. Learn if you can pay off your 30-year mortgage early how to pay off your mortgage in 15 years and options to help you pay off your mortgage faster. This means that when you get a mortgage and borrow 400000 your mortgage principal will be 400000.

BETA 7292019 - This spreadsheet is currently a BETA version because I havent tested every possible input combination. For back-end DTI it should not exceed 41 percent. Our Canadian Mortgage Calculator allows you to calculate your monthly mortgage payments and cash needed for the purchase of real estate using current lender rates.

The amount of interest that you pay will depend on your principal balance. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. Of time a variable rate mortgage the interest rate is dictated by the prime rate with any changes reflecting on the principal not the fixed payments and an adjustable rate.

According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan. The central change between a regular mortgage payment and a biweekly schedule is right there in the terminology. Additional mortgage payments have the biggest impact during the first years of the loan.

This calculator will help you to determine the principal and interest breakdown on any given payment number. Amortization refers to. This mortgage calculator with extra payment allows you to add extra contribution to every payment.

Our mortgage calculator includes principal and interest based on your input and estimates property taxes and insurance which you can update for a more accurate monthly mortgage payment estimate. With a biweekly mortgage the situation changes only slightly. A borrower continues to match the principal amount with an additional payment.

The extra payments. Fixed payments paid periodically until loan maturity. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien.

Up to five recurring or up to ten one-time lump sum payments. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. A loan is a contract between a borrower and a lender in which the borrower receives an amount of money principal that they are obligated to pay back in the future.

As you pay off your mortgage the principal that goes towards your mortgage principal will go up while the interest portion will go down. When it comes to DTI ratio the USDA requires front-end DTI at 29 percent. You can check your budget using a mortgage affordability calculator.

Whatever extra you pay today is extinguished debt not accruing any further interest forever. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. NACAs Housing Counselors work with members to prepare them for homeownership including determining an affordable mortgage payment consisting of the principal interest taxes insurance and HOA.

I wish the calculated minimum could be shut off. If you pay additional principal each month your loan or mortgage will be paid earlier than scheduled and you will pay less in interest charges. You will spend on principal on interest.

Also referred to as the.

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Money Management Advice

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

Fha Mortgage Calculator With Monthly Payment Fha Mortgage Mortgage Loan Calculator Mortgage Amortization Calculator

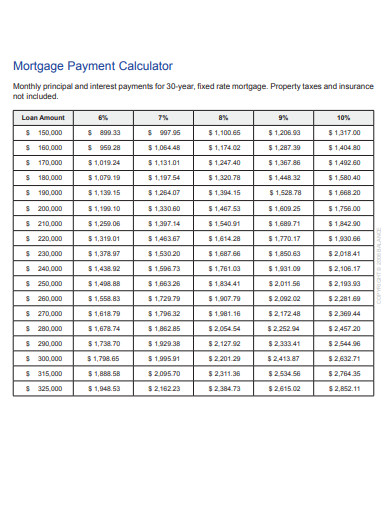

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Printable Mortgage Calculator In Microsoft Excel Mortgage Loan Calculator Mortgage Amortization Calculator Refinancing Mortgage

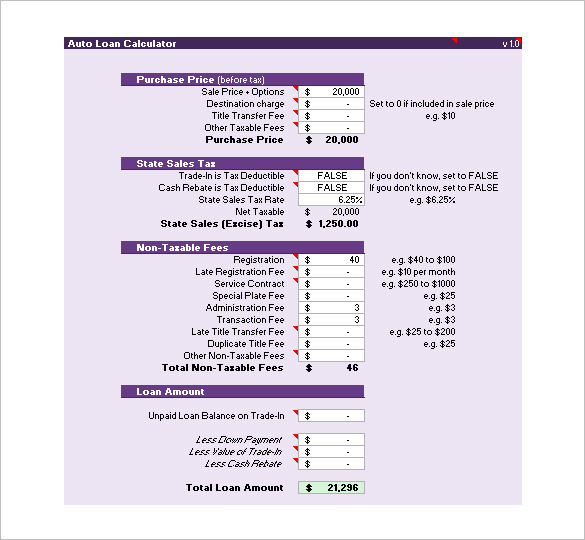

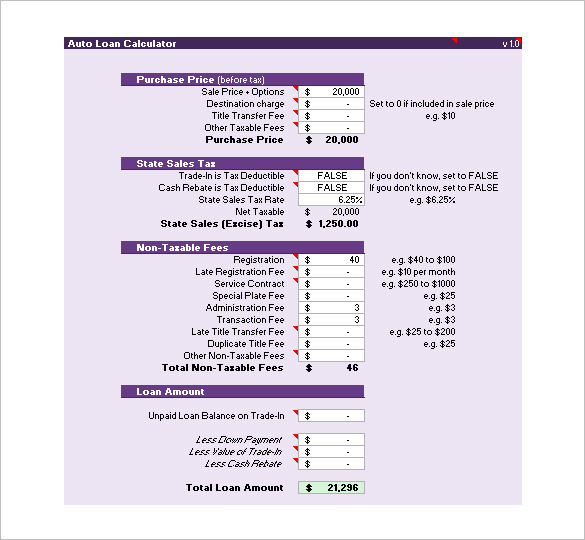

9 Excel Mortgage Loan Calculator Templates Free Pdf Formats

9 Excel Mortgage Loan Calculator Templates Free Pdf Formats

Amortization Schedule Template 13 Free Word Excel Pdf Format Download Free Premium Templates

9 Amortization Schedule Calculator Templates Free Excel Pdf

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

9 Excel Mortgage Loan Calculator Templates Free Pdf Formats

Early Mortgage Payoff Calculator Mls Mortgage Mortgage Payoff Amortization Schedule Mortgage Refinance Calculator

Download Our Free Mortgage Payment Calculator With Extra Principal Payment Excel Template Input Only Fe Mortgage Payoff Free Mortgage Calculator Loan Payoff

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

Amp Pinterest In Action In 2022 Amortization Chart Amortization Schedule Mortgage Amortization Calculator

9 Excel Mortgage Loan Calculator Templates Free Pdf Formats